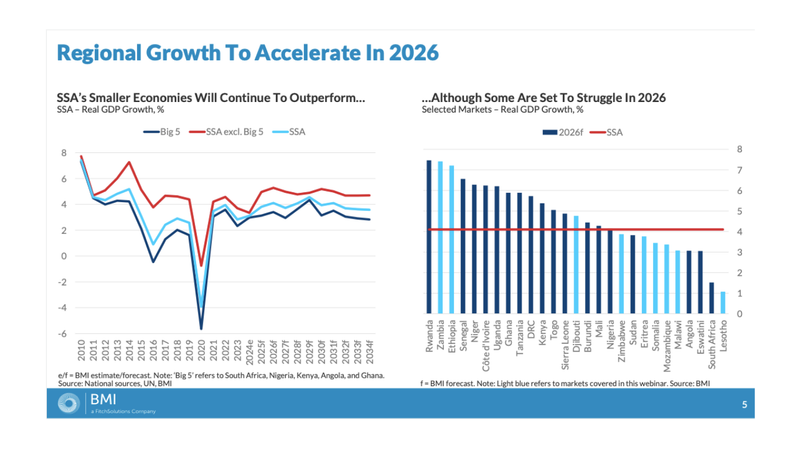

The report shows that while smaller economies in the region will outperform, several countries continue to face major risks that could limit their progress.

Regional outlook

BMI ’s analysis indicates that smaller and mid-tier economies will continue to outperform the region’s largest markets. From 2010 through 2024, these economies have consistently recorded stronger growth than the so-called “Big 5.” This pattern is expected to continue in 2026.

The “Big 5” economies — South Africa , Nigeria, Kenya, Angola, and Ghana — are forecast to expand at a slower pace. Structural issues, including limited investment and weaker productivity, are expected to constrain their performance compared to smaller peers.

Several countries are set to record some of the highest growth rates. Rwanda, Zambia, Ethiopia, Senegal, Niger, and Côte d’Ivoire are listed among the top performers. Other economies such as Uganda, Ghana, Tanzania, and the Democratic Republic of Congo are also projected to deliver solid growth.

Regional growth figures show that momentum in Sub-Saharan Africa will largely come from smaller economies. In 2026, BMI projects the “Big 5” will continue to lag behind the wider group of markets, reinforcing a clear divide.

Some economies are set to struggle in 2026. Zimbabwe, Sudan, Eritrea, Somalia, Mozambique, Malawi, Angola, Lesotho, and South Africa are forecast to post weaker growth compared to the rest of the region.

Southern Africa focus

The analysis highlights how Lesotho, Malawi, Mozambique, Zambia, and Zimbabwe are entering 2026 with very different economic conditions, shaped by both domestic and external pressures.

Lesotho: Tariffs and aid dependence

Lesotho’s economy is slowing under the weight of US tariffs. Real GDP growth is forecast to remain weak in 2025 and 2026. The country is heavily reliant on exports to the United States, which account for around 40–50% of total exports. Added to this, Lesotho is exposed to a fall in development aid. USAID funds represented a significant share of GDP in 2023, leaving healthcare especially vulnerable. The report notes that HIV prevalence remains high, with more than 20% of adults aged 15–49 affected.

Malawi: Election and weak economy

85-year-old Peter Mutharika secured a resounding win in the September 16 presidential election, signalling a demand for political change. However, parliamentary seats remain divided between the Democratic Progressive Party and the Malawi Congress Party, meaning policymaking will require cooperation. Malawi’s economy faces major hurdles. The fiscal deficit has stayed above 10% of GDP in recent years, and the current account is also in deficit. Real GDP growth is forecast to remain below 4%, showing the country’s vulnerability to aid shocks and external disruptions.

Mozambique: Recovery under pressure

Mozambique’s economy is projected to recover, but at a slower pace. Real GDP growth for 2025 and 2026 is forecast below the 2014–2023 average. The report highlights continued political and social risks, with the society risk index showing elevated scores. Foreign reserves are expected to improve slightly, supporting exchange rate stability. The metical is forecast to remain stable against the US dollar under BMI’s base case scenario.

Zambia: Growth and fiscal improvement

Zambia’s macroeconomic outlook is more positive. Real GDP growth is expected to accelerate in late 2025 and into 2026. Fiscal consolidation is also underway, with revenue and expenditure levels improving. However, political uncertainty remains. While President Hakainde Hichilema is in a strong position ahead of the 2026 election, his United Party for National Development risks losing legislative control, which could complicate policymaking.

Zimbabwe: Short-term gains but inflation persists

Zimbabwe’s short-term outlook has improved due to stronger performance in agriculture and gold production. Real GDP growth is forecast to remain positive through 2026. Inflation, while slowing, is still high and remains a challenge for households and businesses. Public confidence in government performance is low, with surveys showing high dissatisfaction on issues such as job creation, corruption, and living standards.

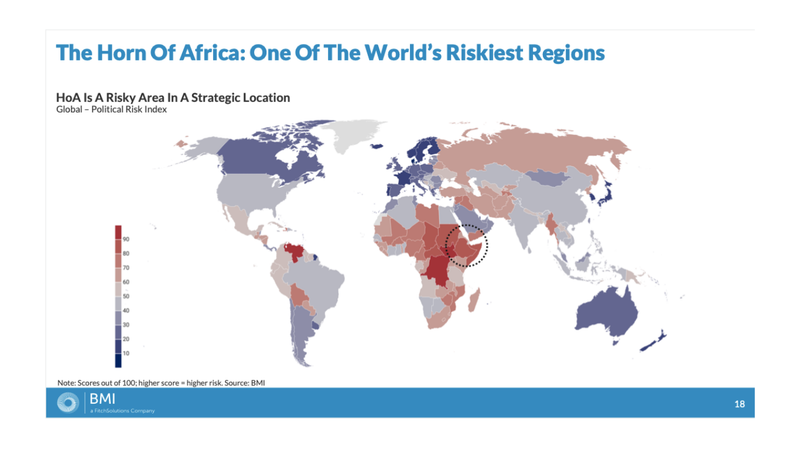

Horn of Africa outlook

The Horn of Africa is described as one of the riskiest regions in the world despite its strategic location along major global shipping routes—the Red Sea and Gulf of Aden.

Political tensions and security challenges remain widespread.

According to the report, Ethiopia, which recently inaugurated the $5 billion Grand Ethiopian Renaissance Dam (GERD) , is forecast to grow by an average of 7.2% between 2025 and 2034, far higher than its neighbours. Djibouti is expected to grow at 4.2%, while Eritrea will expand at 3.8%. Somalia is projected to record the weakest performance, averaging 2.8% growth over the same period.

Despite Ethiopia’s strong outlook, the commentary warns that security challenges could weigh on growth. Data shows rising fatalities from incidents in regions such as Amhara, Oromia, and Tigray. BMI highlights that ongoing domestic instability remains a key downside risk.

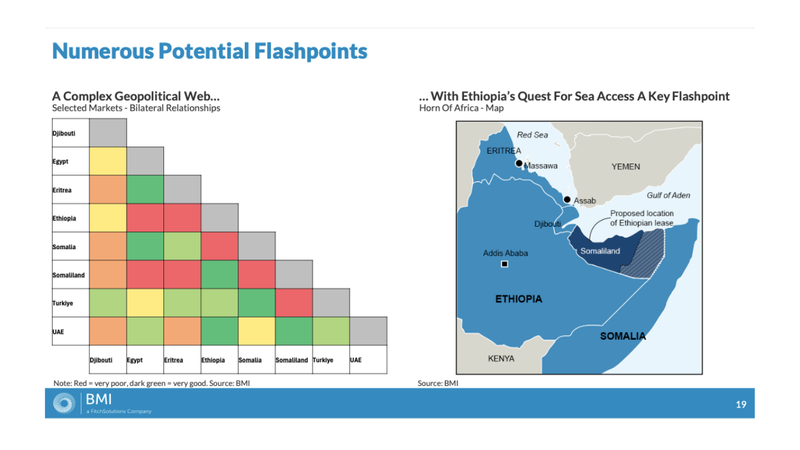

A complex network of bilateral relationships among Djibouti, Eritrea, Ethiopia, Somalia, and external powers such as the UAE and Turkiye adds to geopolitical tensions. Ethiopia’s search for sea access has also been identified as a potential flashpoint.

BMI’s Country Risk & Industry Research covers more than 200 countries and over 20 industry sectors.