FSI BLOG – The UK fintech sector has long been a global leader, driving innovation and transforming financial services. However, industry experts warn that UK fintech needs a lot of support to sustain its growth and competitiveness. Without the right support, fintech firms may struggle to compete with international counterparts, stalling the industry’s potential.

So, what are the challenges? What kind of support does the industry need? Let’s dive in and explore.

Table of Contents

| Sr# | Headings |

|---|---|

| 1 | The Importance of Fintech in the UK Economy |

| 2 | Challenges Facing the UK Fintech Sector |

| 3 | Funding Shortages and Investment Issues |

| 4 | Regulatory Hurdles and Compliance Burdens |

| 5 | Talent Shortage and Skills Gap |

| 6 | Competition from Global Markets |

| 7 | The Role of Government and Policymakers |

| 8 | How the UK Can Boost Fintech Growth |

| 9 | Public-Private Partnerships in Fintech |

| 10 | Fintech Adoption and Consumer Trust |

| 11 | Impact of Brexit on UK Fintech |

| 12 | The Future of UK Fintech |

| 13 | Success Stories: UK Fintech Firms Making a Mark |

| 14 | Final Thoughts: The Road Ahead |

| 15 | FAQs on UK Fintech Challenges and Support |

The Importance of Fintech in the UK Economy

Fintech is not just about mobile payments or crypto investments—it’s reshaping banking, lending, and financial services. The UK fintech industry contributes billions to the economy, making it a key pillar of financial stability and growth.

Challenges Facing the UK Fintech Sector

Despite its success, fintech in the UK is facing multiple roadblocks. These challenges include funding issues, regulatory complexity, and fierce global competition. Without addressing these problems, UK fintech may lose its global standing.

Funding Shortages and Investment Issues

Startups and scale-ups require significant investment, but recent economic downturns have limited funding availability. Investors are cautious, and many fintech firms struggle to raise capital to expand operations.

Regulatory Hurdles and Compliance Burdens

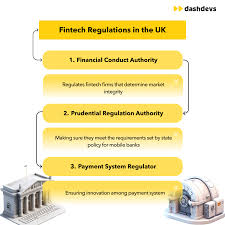

Fintech companies must comply with strict regulations, which can be time-consuming and costly. While regulations protect consumers, excessive bureaucracy can slow down innovation and discourage new entrants.

Talent Shortage and Skills Gap

Fintech thrives on talent, but there’s a shortage of skilled professionals in areas like cybersecurity, blockchain, and AI. Many firms struggle to hire the right talent, hindering their ability to innovate and grow.

Competition from Global Markets

Other countries, such as the US and China, offer strong fintech ecosystems. If the UK fails to provide adequate support, fintech firms may relocate to more favorable environments, leading to a brain drain and loss of economic benefits.

The Role of Government and Policymakers

The government plays a crucial role in supporting fintech. Policies that encourage investment, streamline regulations, and promote innovation can help the industry stay competitive.

How the UK Can Boost Fintech Growth

To support fintech, the UK must:

- Increase funding opportunities through grants and investor incentives.

- Simplify regulations without compromising security.

- Invest in education and training to close the skills gap.

- Strengthen international partnerships to keep the UK at the forefront of fintech.

Public-Private Partnerships in Fintech

Collaboration between government, banks, and fintech startups can drive industry success. These partnerships can help fintech companies access resources, mentorship, and market opportunities.

Fintech Adoption and Consumer Trust

Consumer trust is vital for fintech adoption. Clear communication, transparency, and robust security measures are essential to building trust and encouraging widespread use of fintech solutions.

Impact of Brexit on UK Fintech

Brexit has created uncertainty, affecting regulatory alignment, investment, and talent acquisition. To remain competitive, the UK must adapt quickly to post-Brexit challenges.

The Future of UK Fintech

Despite the hurdles, the UK fintech industry has the potential to remain a global leader. With the right support, innovation will continue to thrive, benefiting businesses and consumers alike.

Success Stories: UK Fintech Firms Making a Mark

Several UK fintech firms have overcome challenges and achieved success. Companies like Revolut, Monzo, and Wise continue to grow, proving that with the right strategy, UK fintech can flourish.

Final Thoughts: The Road Ahead

The UK fintech industry needs more support to navigate funding shortages, regulatory challenges, and international competition. By working together, government, investors, and fintech firms can secure a bright future for the sector.

FAQs on UK Fintech Challenges and Support

1. Why does UK fintech need more support? UK fintech faces funding shortages, regulatory hurdles, and talent shortages, making it harder to compete globally.

2. How can the UK government support fintech firms? The government can provide funding, streamline regulations, invest in skills development, and encourage international partnerships.

3. What impact does Brexit have on UK fintech? Brexit has led to regulatory uncertainty, reduced investment, and talent acquisition challenges for fintech firms.

4. Are UK fintech startups struggling to find investors? Yes, economic downturns have made investors more cautious, making it difficult for startups to secure funding.

5. What is the future of UK fintech? With the right support, UK fintech can continue to lead the global market, drive innovation, and strengthen the economy.